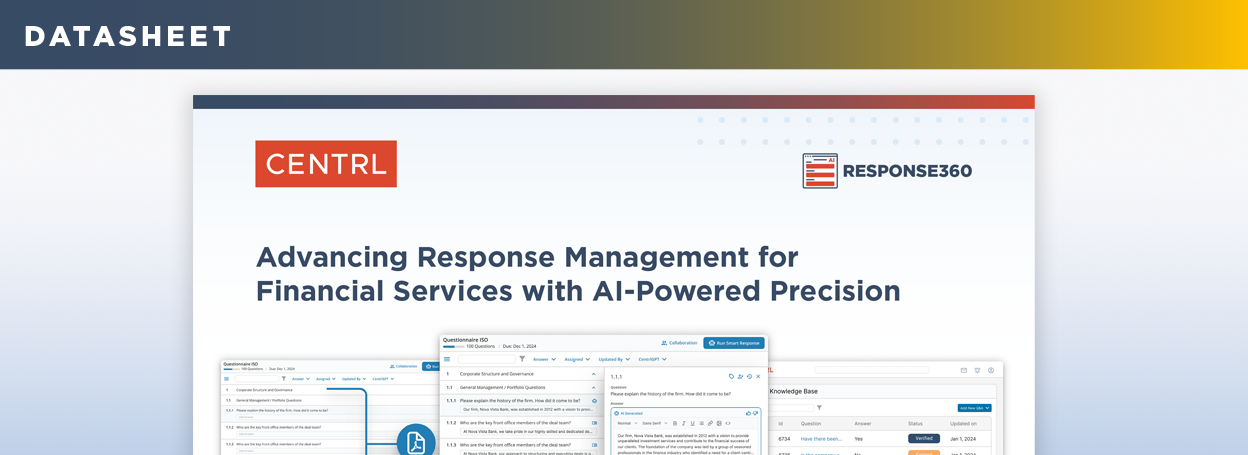

CENTRL Response 360 Product Overview - Data Sheet

Response360: Advancing Response Management with AI-Powered Precision

CENTRL Announces Client Case Studies Showing Major ROI From Its AI Solutions

CENTRL Announces Significant ROI for Investment Managers Leveraging Its Generative AI Solutions.

Top 10 EU Global Bank Sees 80% Efficiency Gains By Fully Automating DDQs with BNM360 and Invoice Aggregation

Top 10 EU Global Bank Sees 80% Efficiency Gains By Fully Automating DDQs with BNM360 and Invoice Aggregation.

Response360: The Revolutionary Solution for DDQ and RFP Responders

Response360 is the first of its kind generative AI solution for questionnaire respondents of DDQs, RFPs and security questionnaires. Leveraging cutting-edge generative AI technology, Response360 dramatically reduces time spent answering questionnaires while increasing the accuracy of responses.

The Potential Impact of ESG on Due Diligence in Enterprise Financial Services

In this article, we discuss ESG and its implications for EFS. We also analyze the challenges around due diligence for EFS organizations and how platforms like CENTRL's DD360 and BNM360 can help.

5 Best Practices for Optimizing Data Use in Bank Network Management

Learn the challenges of data collection for financial institutions and some tips for optimizing data use in bank network management.

CENTRL Adds Continuous, Real-time Cyber Risk Monitoring Powered By BlueVoyant

CENTRL partners with BlueVoyant to provide continuous monitoring and mitigation of vulnerabilities in third parties across the global Securities Services and Investment Management ecosystem.

ESG For Bank Network Management: What You Need to Know

Learn about ESG criteria, its impact on global bank network management, and how you can incorporate ESG into your due diligence practices.

Network Management – Moving Towards a Brave New World

Learn more about network management and check if network managers can be entrusted with monitoring cyber risks at their sub-custodians.

4 Crucial Reasons Why BNM Software is a Smart Investment

Learn about the four critical reasons for investing in a world-class BNM platform like BNM360 and how it can help ease the challenges of Bank Network Management.

How Digitization Can Streamline Bank Network Management and Due Diligence

Here we share how digitizing your bank network management and due diligence processes can help you better monitor your network, control risk, and streamline operations.

Guide to Operational Risk and Compliance Risk in Financial Services

Learn more about operational risk management and compliance best practices in the financial services industry.

The Network Forum 2022: Connecting Financial Institutions Worldwide

The must-attend event for the network management, custody, and post-trade community. Use the conference to connect with our experts in-person. Visit our booth, or arrange your personal appointment today.

The Impacts of COVID-19 on Bank Network Management

Discover how the pandemic has impacted Bank Network Management and what key elements you can leverage for your company.

BNM360 Helps Top 10 Global Bank Automate and Centralize Bank Network Oversight of Third-Party Risk Management

Leading global bank discovers a flexible and powerful solution for streamlining risk management with CENTRL.

Build vs. Buy Guide for Risk and Due Diligence Platforms

Here, we share the process we use to help clients determine whether they should build a risk and due diligence platform in house, or purchase software.

Bank Network Management: What Can We Expect to See in 2022?

Hear the top challenges from recent years and the trends that network managers can expect to see in 2022.

6 Best Practices for Global Bank Network Management

At CENTRL, we serve bank network managers and agent banks every day. This blog will expand on some of the best practices we see.

Global Bank Network Management: Build vs Buy

Find out whether you should build or buy a global bank network management platform in this blog.

Bank Network Management in a Remote World

The post-2020 remote world has had an impact on global bank network management. This blog explores some of the implications.

Keeping Up With Bank Network Management

Global bank network management has been changed by COVID-19. This blog outlines the major impacts and what they mean for financial institutions.