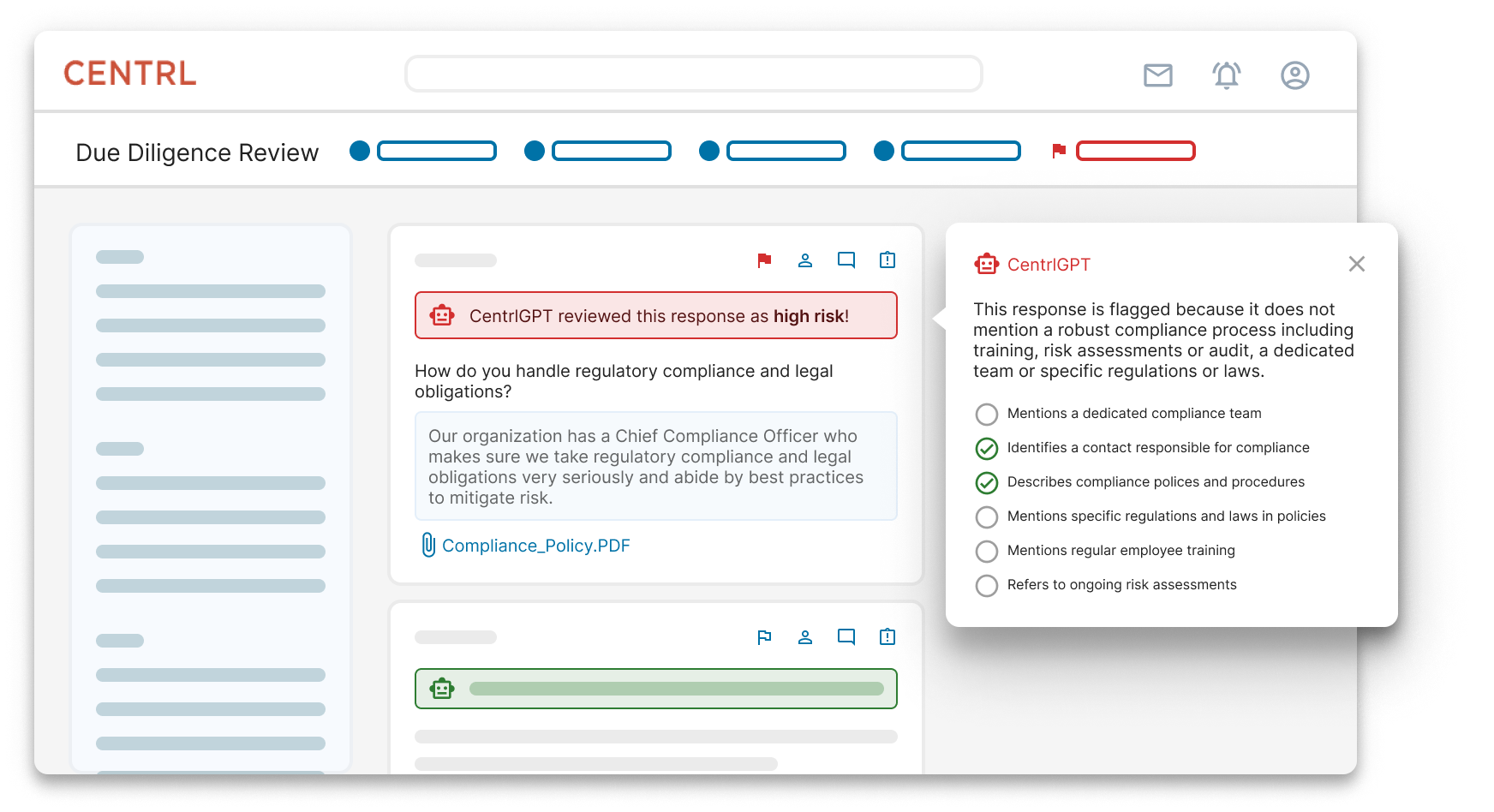

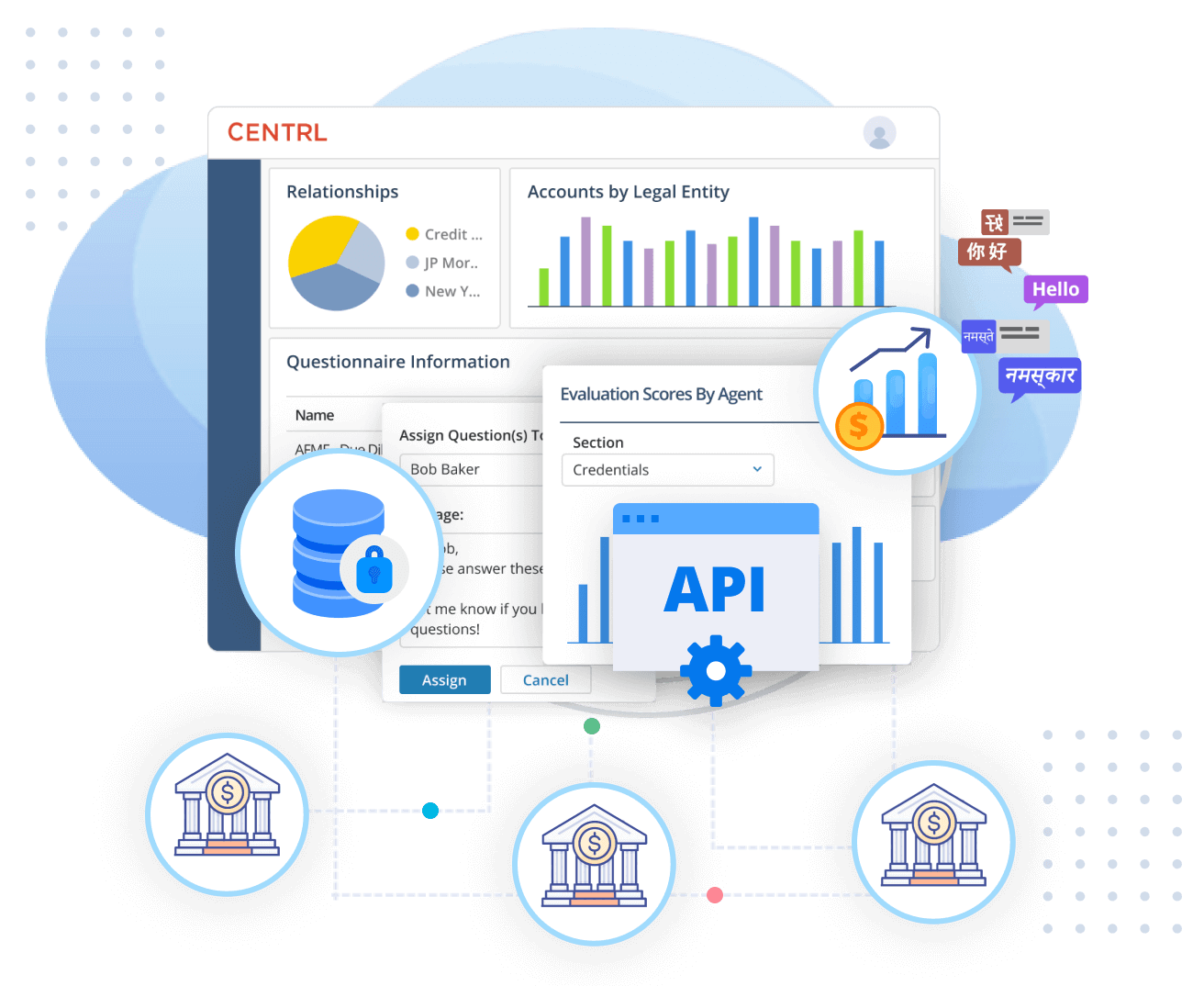

Groundbreaking Generative AI Solution Designed To Transform Risk and Diligence Oversight

- Functions as an AI Analyst seamlessly collaborating with human analysts, amplifying expertise and efficiency

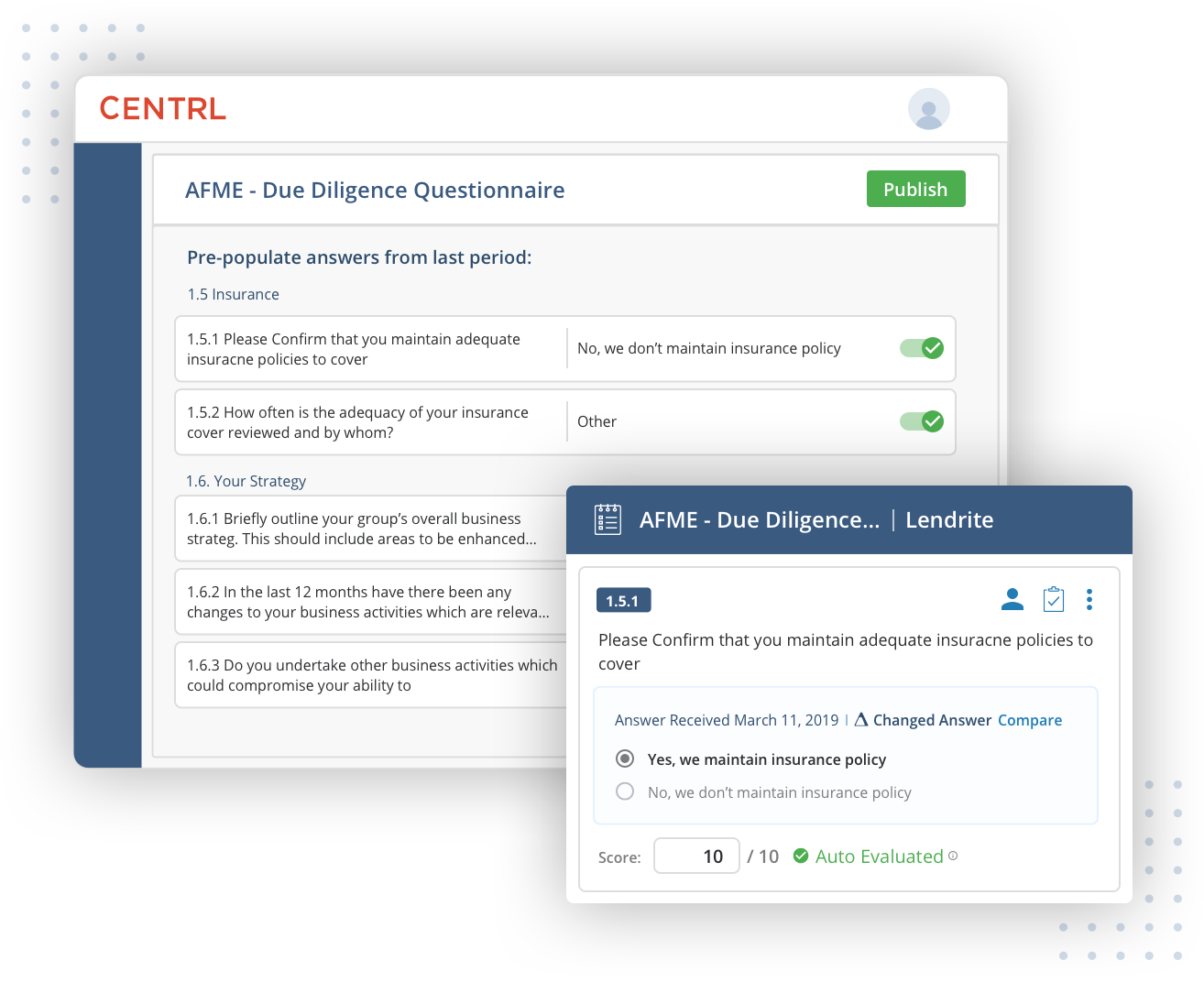

- 100% traceability, logging every response with a comprehensive and detailed audit trail for transparency

- Learns from user behavior and feedback to continuously improve AI accuracy and performance

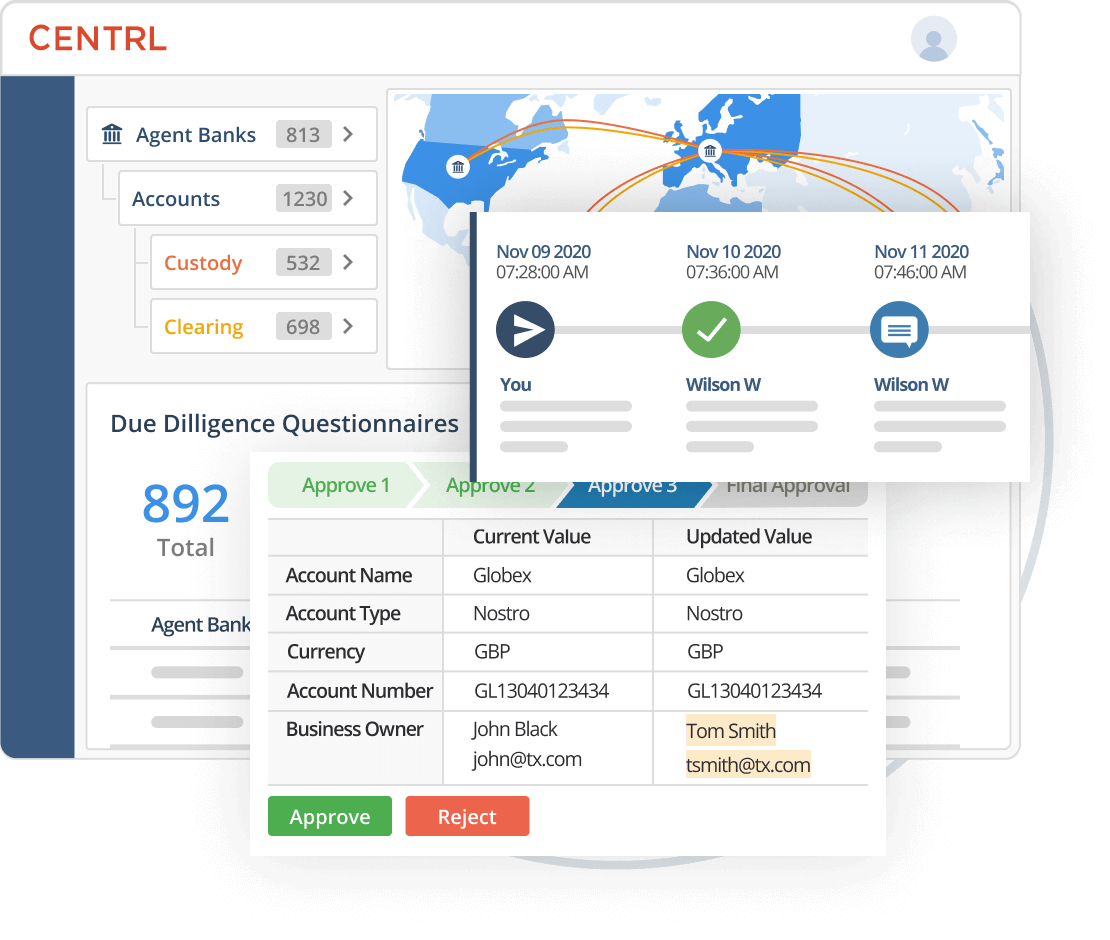

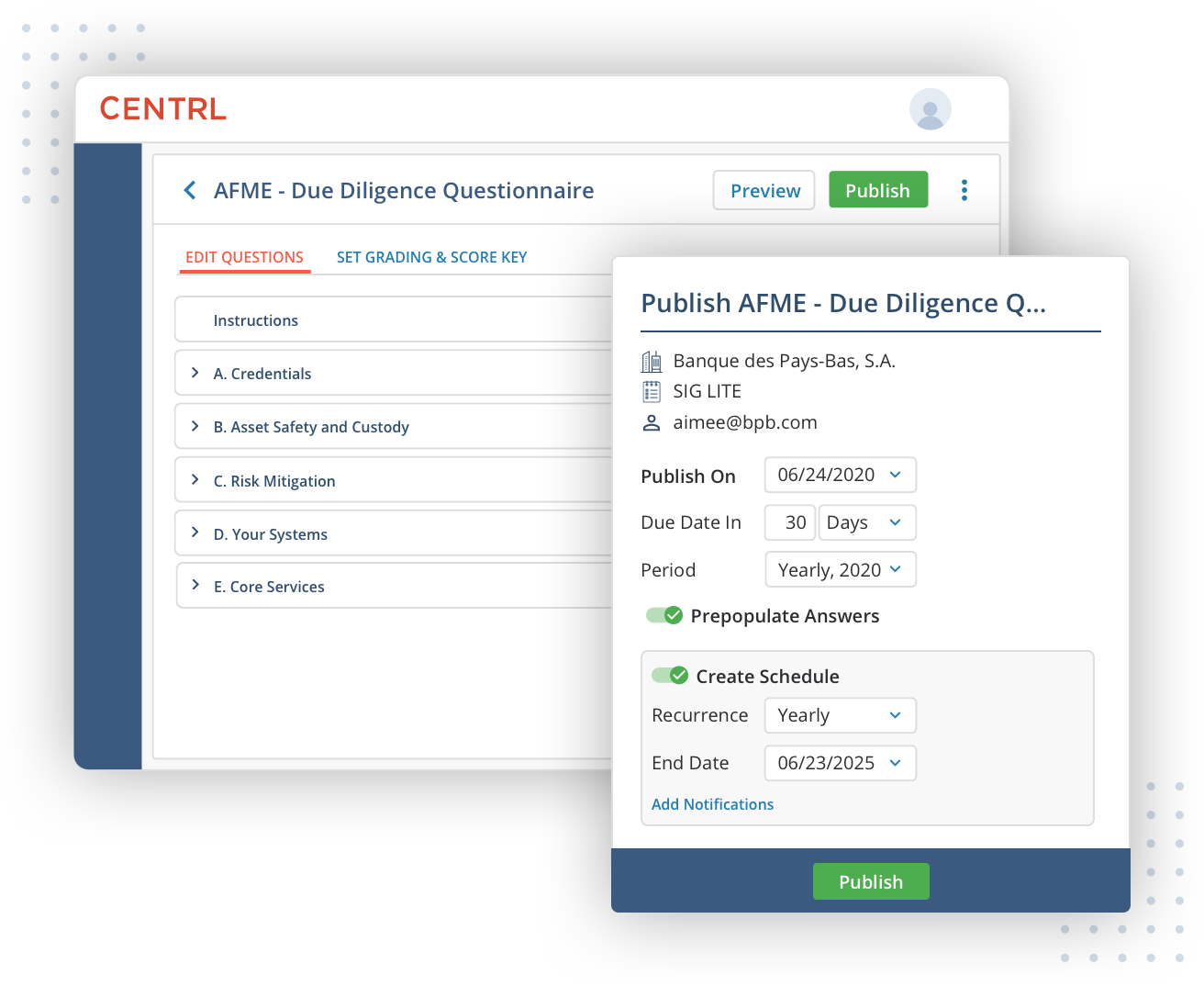

- Provides efficiency by completing diligence related tasks in minutes, rather than days.Achieves an outstanding accuracy rate of over 95%

- Delivers enterprise-grade security, ensuring the highest level of data protection